Final Up to date on November 26, 2023 by way of Nick

Investment is an important for any trade to make bigger. Until you’re self-funding your startup, you’ll for sure wish to search investment from an out of doors supply, whether or not it’s an investor, a trade startup mortgage, or every other manner.

The startup investment panorama might appear intimidating should you’re simply beginning to search for capital to propel your small business. Alternatively, analysis and intentional strategizing can push you towards the investment you want to take your small business to the following degree.

On this article, we’ll talk about the whole thing you want to find out about navigating the investment panorama as a startup. We’ll get started by way of reviewing the fundamentals of investment for startups and the to be had investment varieties earlier than entering some actionable pointers and tips.

Contents

- 1 The Fundamentals of Trade Investment for Startups

- 2 Varieties of Investment for Startups

- 3 10 Investment Guidelines for Startups

- 3.1 1. Be Strategic

- 3.2 2. Highest Your Pitch

- 3.3 3. Hook up with Buyers

- 3.4 4. Make Networking a Precedence

- 3.5 5. Learn about Potential Buyers

- 3.6 6. Turn into a Higher Negotiator

- 3.7 7. Believe Choice Investment Choices

- 3.8 8. Get ready to be Vetted

- 3.9 9. Set Lifelike Expectancies

- 3.10 10. At all times Have a Plan B

- 4 Ultimate Ideas

The Fundamentals of Trade Investment for Startups

Whether or not you’re able to scale your startup or have a trade thought you wish to have to deliver to existence, investment is very important to lend a hand flip your dream right into a truth.

There are such a lot of variables relating to investment a startup, so it’s crucial to grasp the investment panorama.

As an example, many kinds of investment for startups are appropriate for various use instances. Plus, each trade will want a other sum of money for various issues, so it’s an important to get very granular with the quantity you’re inquiring for.

It’s additionally price noting that buyers are incessantly extra than simply resources of cash. They may be able to function mentors and advisors in your group. Their connection for your emblem too can raise your perceived price amongst your target market.

Varieties of Investment for Startups

Earlier than we dive into the information and tips you’ll use to safe investment in your startup, you will have to perceive the choices within the investment panorama. With that stated, let’s take a minute to check the investment varieties to be had for startups.

Mission Capitalists

Mission capital investment is an possibility for startups that comes to offering cash in trade for fairness within the corporate. This sort of funding is made by way of project capital corporations, which can be companies made up of a number of buyers.

Mission capitalists be expecting to look an important go back on their funding, so they are going to need some degree of involvement within the startup. Decide those expectancies prematurely.

Angel Buyers

Angel buyers are similar to project capitalists in that they make investments running capital in trade for fairness within the corporate. Alternatively, they incessantly make investments as people slightly than as a company.

Some angel buyers affect an organization’s operations, while others are silent companions. You’ll negotiate those phrases earlier than signing at the dotted line.

Startup Trade Loans

A small trade mortgage is a standard trade mortgage that lets you borrow cash to fund your projects. The borrower will have to pay the sum again through the years, and also you’ll need to pay passion. Small trade loans are aimed at startups and small organizations.

Those range from private loans as a result of monetary establishments factor them to a trade entity slightly than a person. Alternatively, like private loans, you’ll get a small trade mortgage at a financial institution or credit score union.

Along with small trade loans from the financial institution, SBA loans also are an possibility. In case you’re unfamiliar, an SBA mortgage is investment from the Small Trade Management, a government-funded group that helps startups and small companies.

In line with the 7(a) & 504 Abstract File from the SBA, the typical 2023 small trade mortgage is $479,685. Companies can use this sort of mortgage for just about all functions, together with:

- Operating capital

- Payroll

- Enlargement

- Apparatus

Crowdfunding

Crowdfunding is a technique to elevate startup capital that comes to pre-selling pieces to shoppers. This sort of investment means that you can chip away at your investment purpose whilst offering a product to each and every investor. Alternatively, it’s price noting that to acquire an important quantity of investment, you’ll wish to promote the speculation to many of us.

As an example, should you’re looking to get started a clothes line, you’ll pre-sell a selected merchandise of clothes to the general public. Your patrons grow to be your “buyers.” Kickstarter and IndieGoGo are two nice platforms for operating crowdfunding campaigns.

Fairness crowdfunding is the same manner of elevating running capital. As a substitute of marketing garments, you permit the general public to shop for income stocks or shares on your corporate.

10 Investment Guidelines for Startups

Now that you just’re extra accustomed to the kinds of startup investment to be had, let’s take a look at some most sensible pointers and perfect practices for securing startup investment.

1. Be Strategic

It’s crucial to be strategic as you search running capital for your small business. Take time to map out how a lot investment you want and what you’ll use it for.

Believe the kinds of investment we coated above to resolve which makes probably the most sense so you’ll create a course of action for connecting with the best other people.

Some other section is ensuring you’ve got a forged marketing strategy earlier than significantly pitching to buyers. Search comments for your marketing strategy from mentors or friends with business wisdom. If you recognize any one with enjoy getting trade investment for startups, run your marketing strategy by way of them, too.

2. Highest Your Pitch

Earlier than you search investment, perfecting your pitch is necessary. You will have to know exactly what you want and why you want it. Take that knowledge and broaden a compelling narrative explaining why somebody may wish to again your dream.

Since you can be installed eventualities the place you will have to pitch with little realize, it’s necessary to leverage a pitch deck template to create a qualified presentation to have readily available. That manner, you’ll be sure that you’re able to leap on any alternative that comes your manner.

And don’t fail to remember that observe makes best. Memorize your marketing strategy, know your numbers, and provide all of it with self belief.

3. Hook up with Buyers

Development relationships with buyers is essential whilst you’re looking for startup financing. Get your accounts proper and make the most of bookkeeping for startups to get a correct thought.

You’ll’t simply be expecting other people to provide you with huge sums of cash proper off the bat, so that you’ll have to place effort into getting to grasp potential buyers lengthy earlier than you move in with the pitch.

Whilst it can be tough, it’s essential to make sure that you’re prioritizing authentic connections and authenticity. You don’t wish to come throughout as an opportunist.

4. Make Networking a Precedence

Along with connections with buyers, sturdy business connections, generally, will serve you properly within the investment panorama.

Digital trade playing cards lend a hand make stronger strategic networking and conversation for startup companies. They’re a contemporary networking instrument, and startups require multifaceted approaches to connect to possible buyers and companions.

Simply as digital trade playing cards be offering a concise and dynamic approach of sharing knowledge, startups will have to succinctly provide their worth proposition to possible funders.

Via incorporating digital trade playing cards into your networking methods, you’ll abruptly put across your project, group, and monetary wishes.

All over the investment adventure, those playing cards grow to be virtual ambassadors, encapsulating the essence of the startup and facilitating impactful connections.

In different phrases, it creates a synergy that empowers you to navigate the intricate investment panorama hopefully whilst forging connections that may catalyze your enlargement.

5. Learn about Potential Buyers

Earlier than you pitch to buyers, it’s crucial to do your analysis. You will have to find out about earlier projects they’ve participated in as an investor, trade proprietor, or operator.

Getting to grasp your buyers earlier than the assembly will allow you to know the way to perfect discuss to them. It’ll additionally let you hone your pitch particularly for the individual you’re talking to.

Plus, this analysis will let you resolve in the event that they’re a just right are compatible and display you what they are able to deliver to the desk.

Many buyers additionally make nice advisors. If you want lend a hand discovering knowledge on positive buyers, take a look at Crunchbase or LinkedIn for more info about their newest tasks and accomplishments.

6. Turn into a Higher Negotiator

Securing startup trade investment calls for negotiation. When an investor or project capital company will give you an be offering, you’ll negotiate the phrases of ways a lot stake they get for his or her funding.

You’ll grow to be a greater negotiator by way of studying negotiation ways and learning perfect practices. On the finish of the day, observe makes best, so should you’re no longer nice at negotiations initially, you’ll recuperate with time.

7. Believe Choice Investment Choices

We mentioned probably the most primary kinds of investment for startups previous on this article, but when the ones don’t paintings, you will have to get ingenious. In case you’re suffering to get running capital thru extra conventional approach, an incubator or grant may well be an possibility.

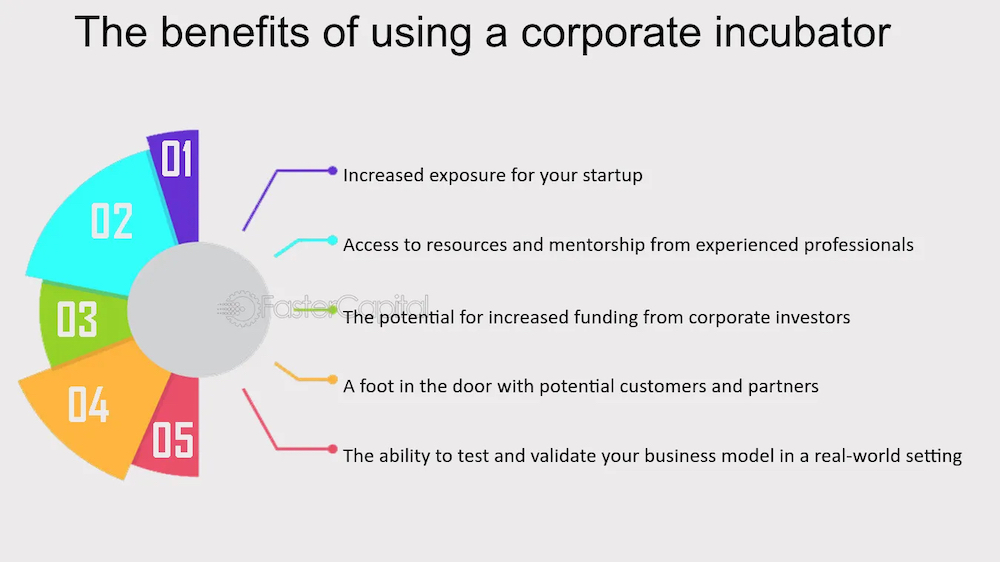

A well-liked technique to elevate startup investment is thru an incubator. Trade incubators are most often teams of marketers who sponsor new companies to lend a hand them develop. They incessantly give you the workspace, steerage, and sources they wish to get off the bottom.

Small trade grants can be an possibility for startup investment. This sort of startup trade investment can come from the Small Trade Management (SBA) or different organizations that intention to stimulate the native economic system.

What’s great about small trade grants is that you just don’t wish to pay off them, so that you received’t pay passion.

A trade bank card is an possibility for many who have struck out somewhere else. Alternatively, within the startup section, this will also be dangerous since failing to pay your small business bank card on time may just give your small business a bad credit report ranking. At the certain facet, it may possibly additionally assist you to construct a trade credit score historical past.

8. Get ready to be Vetted

When potential buyers grow to be severe, they’ll certainly do due diligence on you and your emblem.

As a trade proprietor looking for investment, you’ll be expecting your potential buyers to do a deep dive into your small business’s ancient and present monetary state of affairs. The purpose? Discover the interior scoop at the group’s possible.

They’ll wish to find out about your property and liabilities as properly. Throughout due diligence, you will have to be as coming near near and clear as imaginable. Don’t attempt to conceal skeletons within the closet as a result of issues will pop out.

It’s perfect to be truthful in regards to the much less interesting issues.

9. Set Lifelike Expectancies

Navigating the investment panorama calls for atmosphere lifelike expectancies. This mindset will let you make the perfect use of your time and sources. And take note, having a enlargement mindset could make the entire distinction, permitting you to embody demanding situations and be informed from setbacks.

As an example, should you don’t have a forged marketing strategy, other people most likely received’t wish to make investments with you. You will have to be reputable if you wish to have an creation to respected buyers or project capitalists.

A part of that is understanding that securing investment takes time. With that stated, get started prospecting for investment manner earlier than you propose to make use of the cash. Via beginning early, you’ll make sure that you’ve got the startup capital you want every time you want it.

10. At all times Have a Plan B

It’s crucial to acknowledge that not anything within the startup investment panorama is ultimate till the ink dries. Nice alternatives might come, however they are able to move simply as temporarily. That’s why it’s sensible to all the time have a backup plan and entertain a couple of investment choices concurrently.

Plus, just about one in each 5 companies will fail inside the first 12 months. The reason? Loss of money go with the flow to stay them operating like a well-oiled device. Organising a backup plan to safe investment is helping save you your small business from changing into every other statistic.

To not point out, having a couple of alternatives to be had to you will give you leverage for negotiations. As an example, if in case you have a greater be offering from a much less interesting investor, you’ll take that provide for your preferrred investor as a negotiation tactic.

Ultimate Ideas

In search of trade investment in your startup might appear to be a frightening process, however taking the time to arrange will make it more uncomplicated.

Via figuring out the kinds of investment to be had and the most productive practices for hitting it off with buyers, you’ll be in a super place to kick off your fundraising adventure.

Take note, each startup is exclusive. So is your trail to monetary backing. And whilst price range gasoline the adventure, it’s your imaginative and prescient, resilience, and flexibility that hang you steadfast and let you accomplish your targets.

What form of startup investment are you maximum occupied with? And how are you going to use it to take your small business to the following degree?

Right here’s for your luck!

<a href="https://wpfixall.com/">WP Maintenance Plans</a>