In these days’s virtual age, the ease of on-line transactions has change into an integral a part of our day-to-day lives. From ordering groceries, buying the newest devices, to managing our price range, the web has revolutionized the best way we habits transactions. Then again, as the amount of on-line transactions continues to surge, so does the significance of making sure those transactions are safe.

The upward thrust in cyber threats and information breaches has made it crucial for customers to know and enforce safe on-line transaction practices. This now not best safeguards their non-public and fiscal data but additionally fosters believe within the virtual market.

This weblog publish objectives to equip you with the information and gear to navigate the virtual transaction panorama safely and expectantly. We’ll dig into the intricacies of on-line transactions, talk about the possible dangers, and supply sensible tricks to reinforce your transaction safety.

Contents

- 1 Other Sorts of On-line Transactions

- 2 Retaining On-line Transactions Safe

- 3 Why On-line Transaction Safety Issues?

- 4 Commonplace Threats in On-line Transactions

- 5 Phishing Assaults And Easy methods to Save you From Being Hooked

- 6 Stumble on Malicious Process on Your Android Telephone

- 7 Securing Your Pc from Id Thieves

- 8 Very best Practices for Safe On-line Transactions

- 9 10 Very best Loose Desktop Password Turbines

- 10 10 Very best VPN Carrier Suppliers for 2023

- 11 Position of Banks and On-line Platforms

- 11.1 1. The Magic of Encryption

- 11.2 2. Double-check with Two-Issue Authentication (2FA)

- 11.3 3. Retaining an Eye Out with Fraud Detection Techniques

- 11.4 4. Protected Passage with Safe Fee Gateways

- 11.5 5. Staying Forward with Common Safety Updates and Patches

- 11.6 6. Following the Regulations with Privateness Insurance policies and Laws

- 12 What to Do If You’re a Sufferer of a Cyber Assault

- 12.1 Step 1: Verify the Safety Breach

- 12.2 Step 2: Achieve Out to Your Financial institution or Carrier Supplier

- 12.3 Step 3: Replace Your Passwords

- 12.4 Step 4: Turn on Two-Issue Authentication

- 12.5 Step 5: Stay an Eye on Your Accounts

- 12.6 Step 6: Document the Cyber Assault

- 12.7 Step 7: Search Skilled Assist

- 12.8 Step 8: Be informed from the Enjoy

- 13 Conclusion

Other Sorts of On-line Transactions

There are a number of varieties of on-line transactions, each and every with its personal particular options:

- E-Trade Transactions: That is while you purchase or promote one thing on-line. For instance, while you order a e-book from Amazon, get meals delivered from an app, or subscribe to a carrier like Netflix. To do that, you want a method to pay on-line, like a credit score or debit card, PayPal, or different virtual wallets.

- On-line Banking Transactions: That is while you transfer cash between other financial institution accounts. For instance, while you pay your expenses on-line, ship cash to a pal, or get your paycheck thru direct deposit. To do that, you want to make use of the safe on-line banking platform equipped by means of your financial institution.

- Cell Pockets Transactions: Cell wallets like Apple Pay, Google Pockets, or Samsung Pay mean you can stay your card data protected in your telephone and make bills at once from there. You’ll be able to use this for on-line purchases and in bodily retail outlets that settle for contactless bills.

- Cryptocurrency Transactions: That is while you use virtual currencies like Bitcoin or Ethereum. Those currencies use a generation referred to as blockchain, which is a device that data transactions throughout many computer systems.

Retaining On-line Transactions Safe

To ensure those transactions are protected, there are a number of gear and applied sciences used. One is Safe Sockets Layer (SSL) and Shipping Layer Safety (TLS), which can be methods designed to stay communique over a pc community safe.

Web sites that use SSL or TLS get started with https:// of their internet deal with, which means that that the ideas you ship between you and the website is stored protected.

Some other device is the firewall, which tests all incoming and outgoing community visitors in accordance with set safety regulations. It acts like a barrier between a community that may be relied on and networks that may’t be relied on.

Why On-line Transaction Safety Issues?

As we do extra of our buying groceries and banking on-line, holding those transactions protected is extra necessary than ever. Right here’s why:

1. Retaining Your Private and Monetary Main points Protected

Each time you purchase one thing on-line or do a little banking, you’re sharing delicate main points like your bank card or checking account numbers. It’s essential to stay those transactions protected to stop this knowledge from being stolen.

For instance, while you purchase one thing from a safe on-line retailer, your fee main points are scrambled right into a code that may’t be learn by means of someone who may attempt to thieve it.

2. Preventing Id Robbery

Id robbery is a large downside on-line. Cybercriminals can thieve your own main points from unsafe transactions and fake to be you. They may be able to open bank cards on your title, empty your financial institution accounts, and even get scientific facilities. Protected transactions forestall this by means of striking boundaries between your data and the criminals.

3. Development Believe with Shoppers

Firms have an obligation to stay their shoppers’ main points protected. In the event that they fail, they are able to lose their shoppers’ believe, which can also be very harmful.

For instance, in 2013, the store Goal had an enormous information breach the place hackers stole the credit score and debit card main points of 40 million shoppers. This breach value Goal $18.5 million and did a large number of harm to their recognition.

4. Assembly Criminal and Trade Regulations

Firms additionally must stick with the regulation with regards to protective buyer information. In the event that they don’t, they are able to face large fines and prison issues.

For instance, the Fee Card Trade Information Safety Usual (PCI DSS) says that businesses that care for bank card data must stay it protected. In the event that they don’t, they are able to be fined between $5,000 and $100,000 each month.

Commonplace Threats in On-line Transactions

As we adventure throughout the on-line transaction global, it’s essential to know the average risks that exist within the virtual realm. Those risks can put your own and fiscal main points in peril, doubtlessly resulting in monetary loss or id robbery.

Let’s discover one of the crucial maximum not unusual threats:

1. Watch out for Phishing Assaults

Phishing is a sneaky tactic the place on-line fraudsters fake to be reputable organizations to trick you into giving freely delicate data. It steadily occurs thru emails that appear to be out of your financial institution or a relied on retailer, asking you to replace your account or verify your password.

For example, you may get an e mail that appears love it’s out of your financial institution, entire with authentic emblems and language, however the hyperlink takes you to a pretend web site designed to thieve your login main points.

.no-js #ref-block-post-17343 .ref-block__thumbnail { background-image: url(“https://property.hongkiat.com/uploads/thumbs/250×160/phishing-reports-prevention.jpg”); }

Phishing Assaults And Easy methods to Save you From Being Hooked

Cybercrime has proven its enamel within the remaining 5 years, maximum predominantly, within the on-line fraud circumstances brought about… Learn extra

2. Malware: A Hidden Risk

Malware, or malicious device, is any device created to break or exploit any computing instrument or community. Malware can sneak into your instrument thru a dangerous e mail attachment, an inflamed device obtain, or perhaps a compromised web site. As soon as it’s in your instrument, it will possibly report your keystrokes to seize passwords, thieve non-public data, or lock your information and insist a ransom.

.no-js #ref-block-post-55256 .ref-block__thumbnail { background-image: url(“https://property.hongkiat.com/uploads/thumbs/250×160/android-phone-victim-of-malicious-acts.jpg”); }

Stumble on Malicious Process on Your Android Telephone

Android’s extremely customizable ecosystem makes it extra susceptible to malware and viruses. Android malware can do a lot hurt… Learn extra

3, Id Robbery: A Severe Worry

Id robbery occurs when on-line criminals pay money for your own data, like your Social Safety quantity, checking account main points, or bank card quantity, and use it to dedicate fraud or different crimes. They might make purchases on your title, open new credit score accounts, and even record tax returns.

.no-js #ref-block-post-27937 .ref-block__thumbnail { background-image: url(“https://property.hongkiat.com/uploads/thumbs/250×160/secure-computer-identity-theft.jpg”); }

Securing Your Pc from Id Thieves

Id robbery is a nightmare everybody may revel in. It may possibly impact folks, companies or even govt businesses that… Learn extra

4. Guy-in-the-Heart (MitM) Assaults: The Invisible Risk

In a MitM assault, the attacker secretly intercepts and in all probability alters the communique between two events who assume they’re at once speaking with each and every different.

For instance, when you’re hooked up to an unsecured public Wi-Fi, an attacker may intercept the knowledge you ship and obtain, together with login main points and bank card numbers.

5. Card No longer Provide Fraud: A Commonplace On-line Rip-off

This sort of fraud occurs in transactions the place the cardholder does now not bodily provide the cardboard to the vendor. It’s not unusual in on-line buying groceries, the place scammers use stolen card main points to make unauthorized purchases.

To protect your self from those threats, it’s the most important to make use of faithful safety device, be cautious of sudden communications, frequently replace your gadgets, and use safe and relied on networks for transactions.

Very best Practices for Safe On-line Transactions

On-line transactions, whilst handy, include their very own set of dangers. Then again, by means of following a couple of ideal practices, you’ll be able to considerably reinforce the protection of your on-line transactions. Listed below are some key methods to imagine:

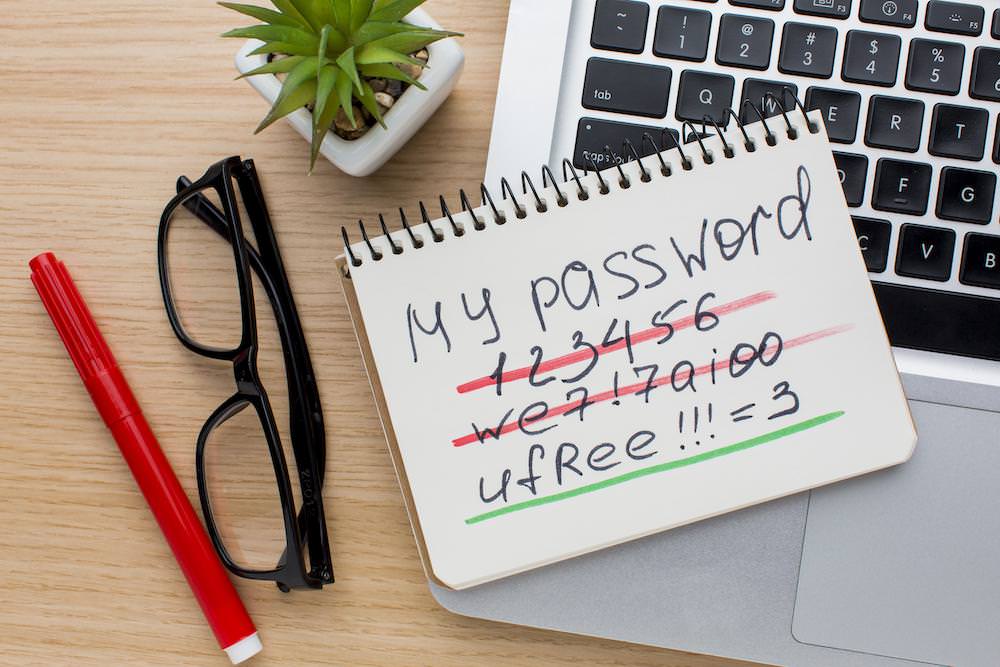

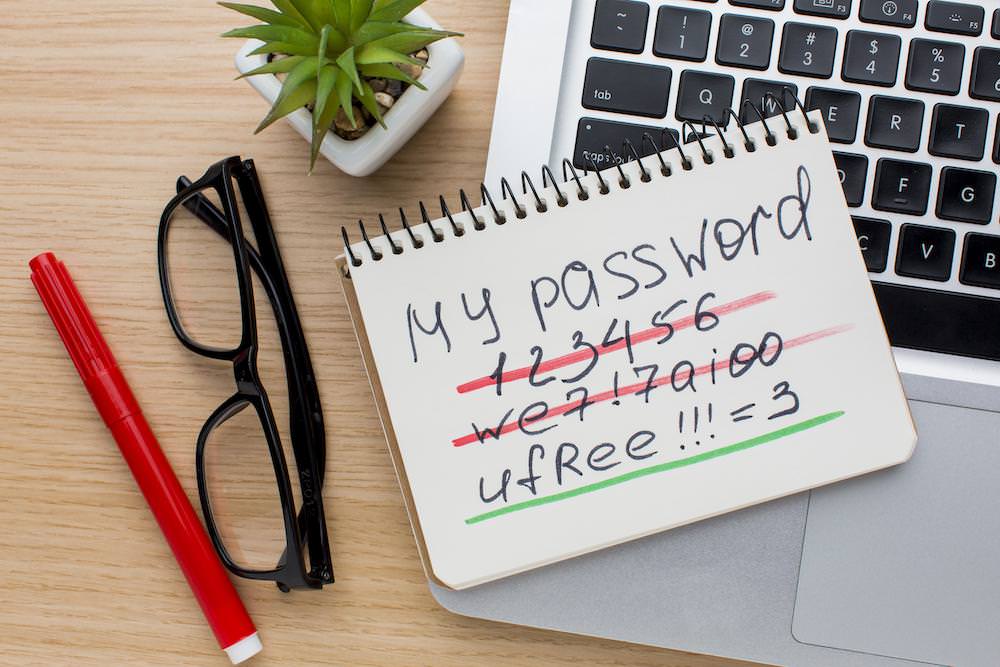

1. Use Robust and Distinctive Passwords

Your password is your first defensive position in opposition to unauthorized get entry to. Remember to use a mix of letters, numbers, and particular characters. Keep away from the usage of simply guessable data like birthdays or names. Imagine the usage of a password supervisor like 1Password, which will generate and retailer advanced passwords for you. On the other hand, you’ll be able to create a passkey if it’s supported.

.no-js #ref-block-post-64289 .ref-block__thumbnail { background-image: url(“https://property.hongkiat.com/uploads/thumbs/250×160/desktop-password-generators.jpg”); }

10 Very best Loose Desktop Password Turbines

Like managing passwords, producing robust password mixtures is not a fab breeze both. Retaining your puppy canine’s title or… Learn extra

2. Ceaselessly Replace Instrument and Units

Cybercriminals steadily exploit vulnerabilities in out of date device. Be sure your running device, internet browsers, and safety device are up-to-date. Maximum methods have an auto-update characteristic – make certain it’s enabled.

3. Use Safe and Depended on Web sites for Transactions

All the time search for https:// within the web site URL earlier than coming into any non-public or monetary data. The ‘s’ stands for safe, indicating that the web site makes use of encryption to offer protection to your information. Depended on internet sites steadily have a padlock icon within the deal with bar.

4. Be Cautious of Suspicious Emails and Hyperlinks

Phishing scams steadily come within the type of emails that seem to be from respected corporations however are designed to thieve your data. By no means click on on hyperlinks or obtain attachments from unknown assets. For those who obtain an e mail out of your financial institution or a buying groceries website, it’s more secure to log in in your account at once slightly than clicking on a hyperlink in an e mail.

5. Use Two-Issue Authentication (2FA)

2FA provides an additional layer of safety by means of requiring two forms of id earlier than granting get entry to. This is usually a mixture of one thing you realize (like a password), one thing you’ve got (like a telephone), or one thing you might be (like a fingerprint). Many facilities, together with Google and Apple, be offering 2FA choices.

6. Observe Your Accounts Ceaselessly

Ceaselessly test your financial institution and bank card statements for any unauthorized transactions. For those who spot the rest suspicious, document it in your financial institution instantly.

7. Use a Safe Community

Keep away from undertaking transactions when hooked up to public Wi-Fi networks, as they’re steadily unsecured and can also be simply intercepted by means of cybercriminals. For those who will have to use a public community, imagine the usage of a Digital Non-public Community (VPN) like SurfShark, or NordVPN, which encrypts your information and gives safe get entry to to the web.

.no-js #ref-block-post-57444 .ref-block__thumbnail { background-image: url(“https://property.hongkiat.com/uploads/thumbs/250×160/best-vpn-services-review.jpg”); }

10 Very best VPN Carrier Suppliers for 2023

The whole lot is being tracked these days, out of your actions on the web in your telephone and pc. Each and every click on,… Learn extra

Position of Banks and On-line Platforms

Banks and on-line platforms play a pivotal position in making sure the protection of on-line transactions. They make use of a mess of complex applied sciences and stringent protocols to offer protection to consumer information and care for the integrity of transactions.

1. The Magic of Encryption

Encryption is sort of a secret code that banks and on-line platforms use to stay your transactions protected. It turns your data right into a secret language that may best be understood with a unique key. You will have heard of Safe Sockets Layer (SSL) or Shipping Layer Safety (TLS) – those are not unusual forms of encryption that offer protection to your information whilst it’s being despatched.

2. Double-check with Two-Issue Authentication (2FA)

Many banks and on-line platforms use 2FA to present your safety an additional spice up. This implies you want to turn out who you might be in two other ways earlier than a transaction can undergo.

For instance, after you input your password (one thing you realize), you may get a novel code despatched in your telephone (one thing you’ve got).

3. Retaining an Eye Out with Fraud Detection Techniques

Banks and on-line platforms use sensible methods to identify the rest strange that may imply fraud. For example, if anyone tries to make a transaction from a spot you don’t most often use, the device may flag it as suspicious and ask for added tests and even block the transaction.

4. Protected Passage with Safe Fee Gateways

On-line platforms steadily use safe fee gateways, like PayPal or Stripe, for transactions. Those gateways have robust safety features to stay delicate data, like your bank card main points, protected.

5. Staying Forward with Common Safety Updates and Patches

Banks and on-line platforms frequently replace their methods and fasten any susceptible spots to ensure they’re secure in opposition to the newest cyber threats. They steadily remind customers to replace their apps or device so they are able to take pleasure in those safety enhancements.

6. Following the Regulations with Privateness Insurance policies and Laws

Banks and on-line platforms additionally must stick with privateness rules and rules, just like the Common Information Coverage Legislation (GDPR) in Europe. Those rules make certain consumer information is secure and can lead to large fines in the event that they’re damaged.

What to Do If You’re a Sufferer of a Cyber Assault

Experiencing a cyber assault can also be rather alarming. Then again, it’s necessary to stick composed and act promptly to minimize the possible hurt. Right here’s an easy-to-follow information on what to do when you change into a sufferer of a cyber assault:

Step 1: Verify the Safety Breach

The preliminary step is to ensure {that a} safety breach has certainly taken position. Indicators of a breach may come with unauthorized transactions in your financial institution remark, indicators out of your financial institution or carrier supplier, or peculiar task in your on-line accounts.

Step 2: Achieve Out to Your Financial institution or Carrier Supplier

If you’ve showed the breach, get involved together with your financial institution or the carrier supplier the place the breach came about. They may be able to help in securing your account, halting any ongoing unauthorized actions, and in all probability reversing fraudulent transactions.

Step 3: Replace Your Passwords

Regulate the passwords of all compromised accounts. For those who use equivalent or an identical passwords throughout more than one accounts, exchange the ones too. It’s possible you’ll wish to imagine the usage of a password supervisor to create and retailer advanced, distinctive passwords for each and every of your accounts.

Step 4: Turn on Two-Issue Authentication

For those who haven’t achieved so already, activate two-factor authentication (2FA) in your accounts. This offers an additional safety layer by means of requiring a 2nd type of verification, reminiscent of a textual content message or biometric information, along side your password.

Step 5: Stay an Eye on Your Accounts

Observe all of your accounts for any strange task. This comprises now not simply your financial institution accounts, but additionally e mail, social media, and some other on-line accounts.

Step 6: Document the Cyber Assault

Tell your native regulation enforcement company and the best on-line platform in regards to the cyber assault. Within the U.S., for example, you’ll be able to document cyber crimes to the Web Crime Criticism Heart (IC3) or the Federal Business Fee (FTC).

Step 7: Search Skilled Assist

If the breach is serious, you may wish to visit a cybersecurity skilled. They may be able to assist decide how the breach came about, what data used to be compromised, and the best way to save you long term assaults.

Step 8: Be informed from the Enjoy

Use this incident as a finding out alternative. Get to grasp not unusual cyber threats and the most efficient practices for on-line safety to safeguard your self sooner or later.

Conclusion

In conclusion, the virtual global gives us exceptional comfort and potency in undertaking transactions. Then again, this comfort will have to now not come at the price of our safety. As we’ve explored on this complete information, safe on-line transactions aren’t only a luxurious, however a need in our an increasing number of interconnected global.

From figuring out the character of on-line transactions and the possible threats they pose, to adopting ideal practices for safety, and figuring out what to do within the tournament of a cyber assault, we’ve lined a variety of subjects designed to empower you, the shopper.

Take note, the important thing to safe on-line transactions lies in being proactive slightly than reactive. By way of imposing the methods and gear mentioned on this information, you’ll be able to now not best offer protection to your own and fiscal data but additionally experience some great benefits of on-line transactions with peace of thoughts.

As we proceed to include the virtual age, let’s make safe on-line transactions a typical follow, now not an afterthought. Keep protected, keep safe, and proceed to navigate the virtual panorama with self belief.

The publish Client Information to Safe On-line Transactions gave the impression first on Hongkiat.

WordPress Website Development Source: https://www.hongkiat.com/blog/secure-online-transactions-consumer-guide/